Coronis Health, Physician

Physician Billing Services

By cultivating a team of PSP medical billing and revenue cycle management experts and utilizing the most advanced technology in the industry, Coronis Health has the unique ability to maximize collections and increase revenue for physician groups of all sizes, from independent primary care physicians and gastroenterologists to large orthopedic surgery facilities and dermatology centers — and everything in between.

Hear What Our Clients Have to Say

Specialized Solutions, Global Capabilities

Risk-Free Financial Checkup

We Find Missing Revenue In 95% Of Our Reviews

– Comprehensive review of your complete revenue cycle

– Compare key metrics against competitors in your specialty

– Review patient and insurance A/R, charges, and fee schedules

*Rate is based on collections volume

Case Studies

Physician Billing Services

Specializing in...

Testimonials

-

35+

Years of Industry Knowledge

-

350+

Practices

-

6M+

Claims Processed Per Year

-

$20000000000

In Charges

-

$4700000000

In Payments

Size Matters! More is Always More!

Services

What Makes Us Different

Coronis Health is a global company with a personal, high-touch service. We brought the most innovative and thought-advancing leaders in medical billing and revenue cycle management together to progress this industry into the modern, technological age. We seek a level of professionalism and analysis you won’t find elsewhere.

-

Personalized Touch

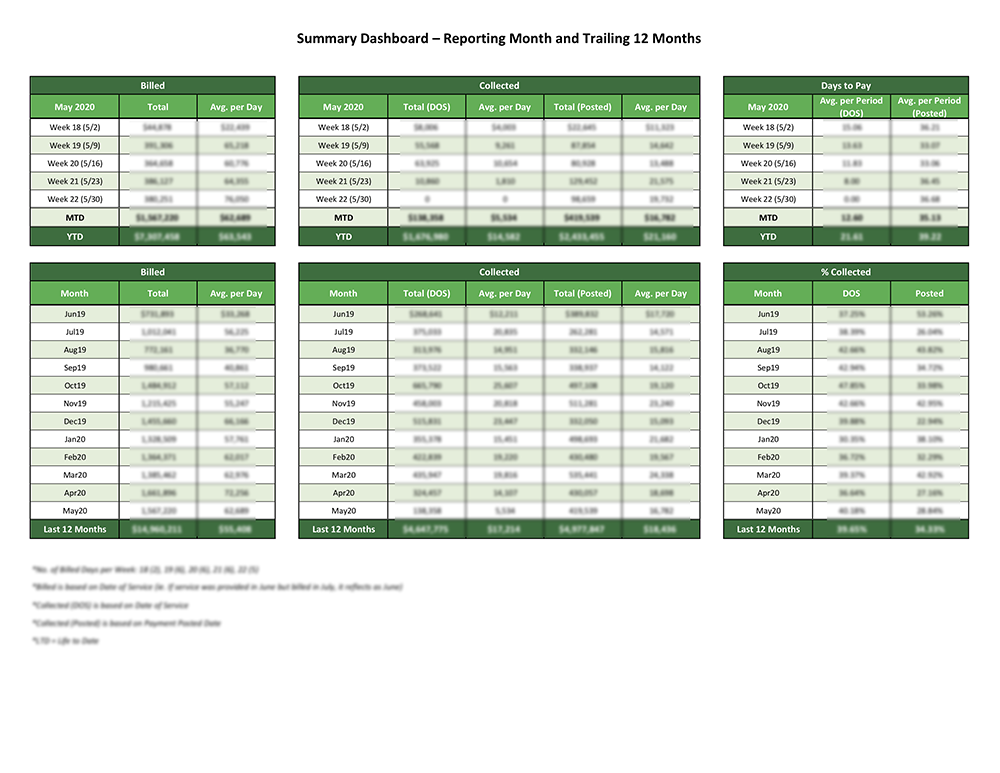

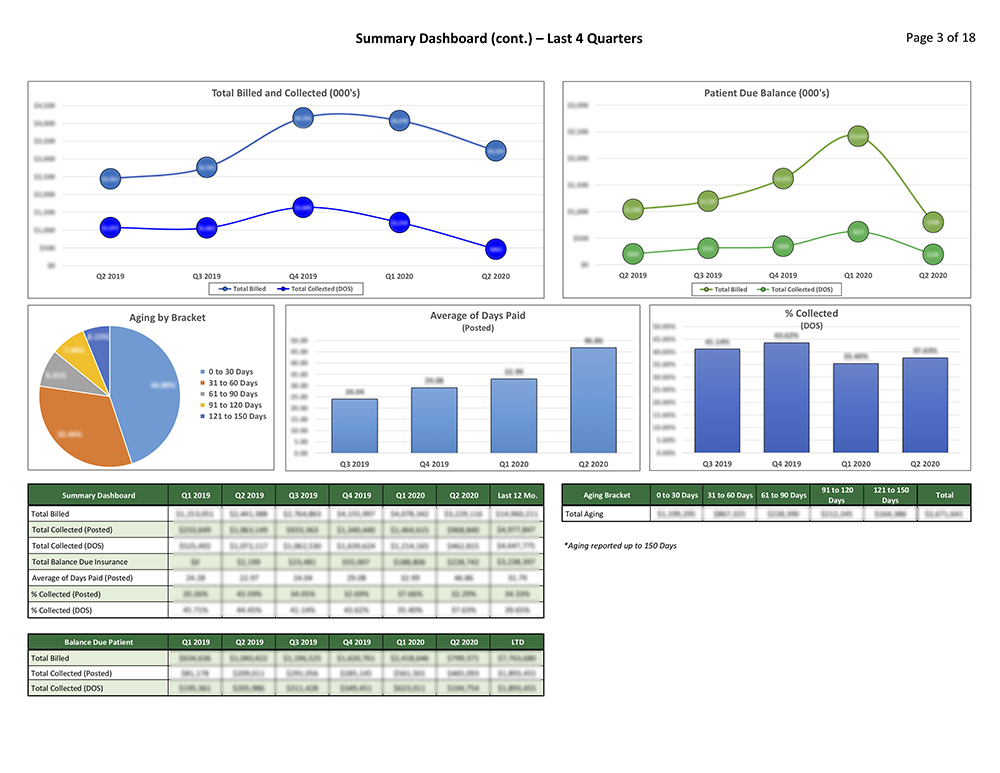

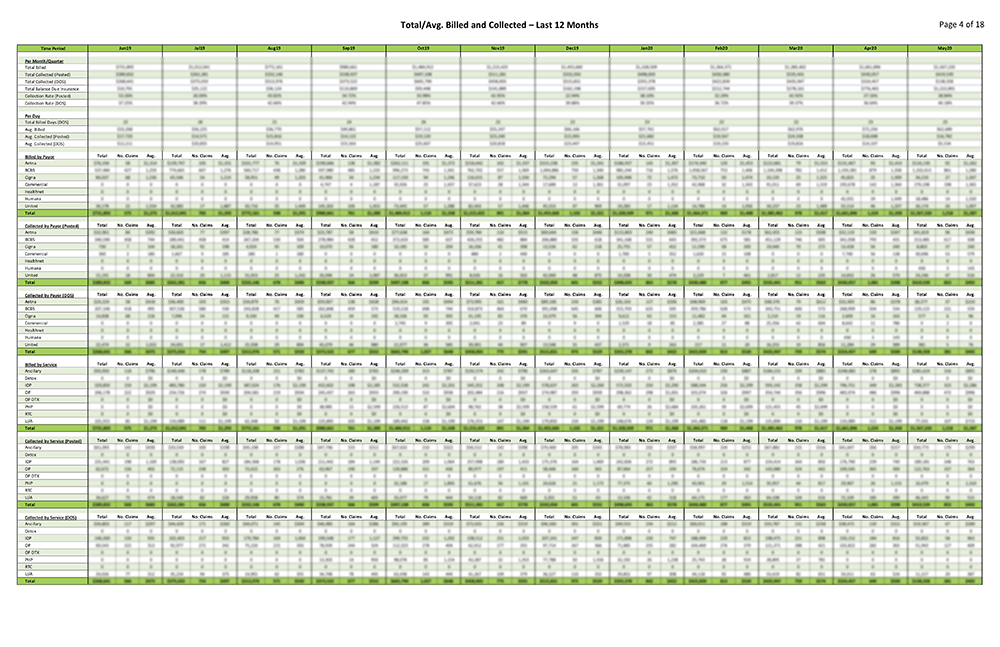

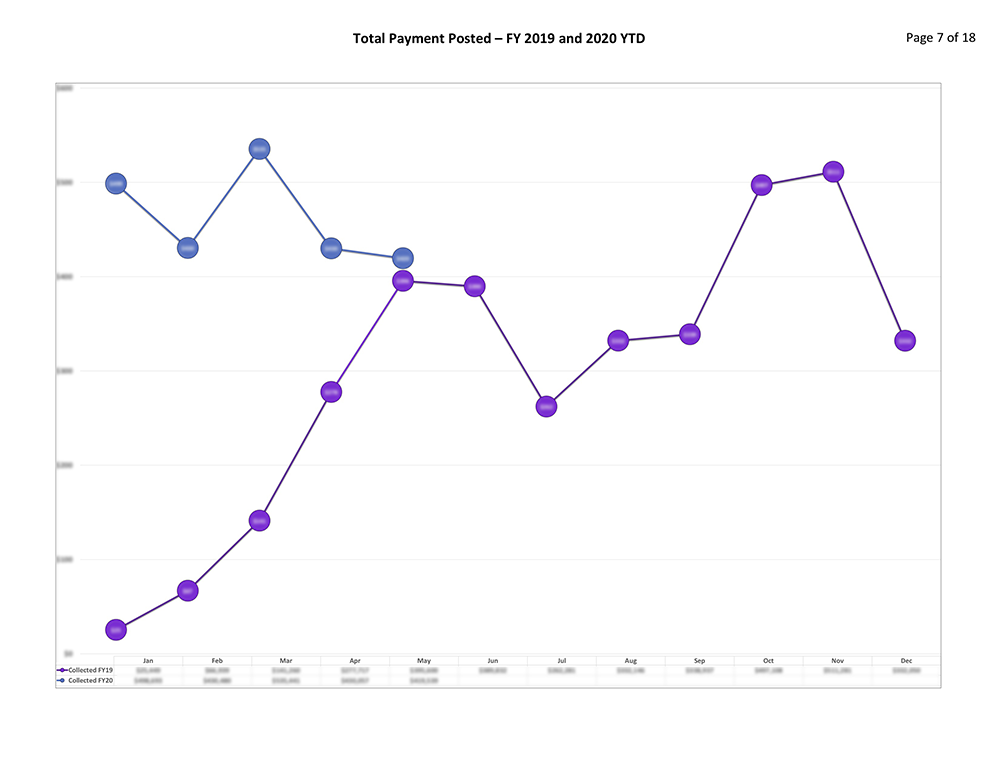

We believe in personalized service that exceeds what most big box companies offer. No customer is the same, so we don’t treat all customers the same. We build professional relationships that anticipate needs and focus on your success. This includes having an experienced manager, based here in the United States who understands how to help your practice succeed. You aren’t just a number, you’re on a first-name basis and a phone call away. With our transparency guarantee, you see what we see. We deliver reports that are clear and digestible and allow you to make the best decisions for your practice.

-

Best of the Best in Medical Billing

Coronis comprises the top medical billers in the country pooling their global resources to bring customers the best in medical billing and revenue cycle management. With over 35+ Years of industry knowledge in various niches including private practices of all sizes.

-

Rapid Implementation & Onboarding

We are fully integrated with the latest software so we input coding instantly, and execute collections fast and efficiently. And because of our full transparency, you’ll know exactly how your numbers look and how they affect your business.

-

Focused On Your Financial Success

We make sure your practice is 100% compliant and able to receive patients and bill either out-of or in-network. Coronis goes after the last dollar using our seasoned team of tireless and tough negotiators. You’ll receive timely, relevant, and accurate information in a way you can understand. We don’t help you just get money, we help you financially grow.

More About Coronis Health

Sophisticated private practices know that their most important financial asset is their billed services and accounts receivable. This asset needs to be safeguarded, well-organized, tightly managed, and carefully maintained by a professional team possessing a perfectionist approach to execution, accuracy, follow-up, and timeliness. And of critical importance, practice managers need to remain constantly vigilant and compliant amid the changing chorus of governmental / carrier billing and documentation regulations and compliance requirements.